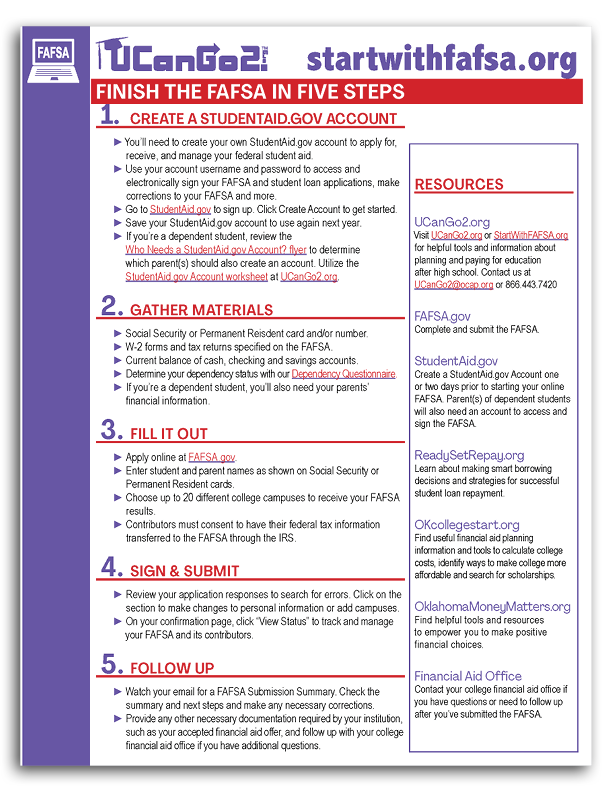

How do I submit the FAFSA?

You should complete the Free

Application for Federal Student Aid (FAFSA) on or after October

1 of your senior year of high school and each year you're in

college. By completing this application, you have applied for most

federal and state financial aid.

- Gather materials

- Create a StudentAid.gov Account

- Fill it out

- Sign & submit

- Follow up

|

|

|

To complete the FAFSA, you will need to create a StudentAid.gov

account. This is essentially a username and password that will

enable you to access and electronically sign your FAFSA, in

addition to visiting certain Department of Education websites. Once

your StudentAid.gov account has been successfully created, you will

be able to complete and sign your FAFSA without delay.

|

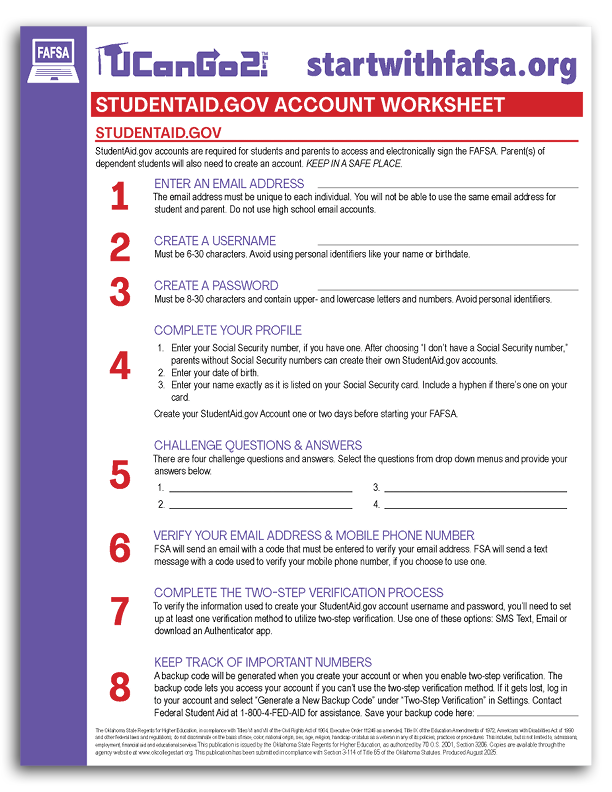

English

|

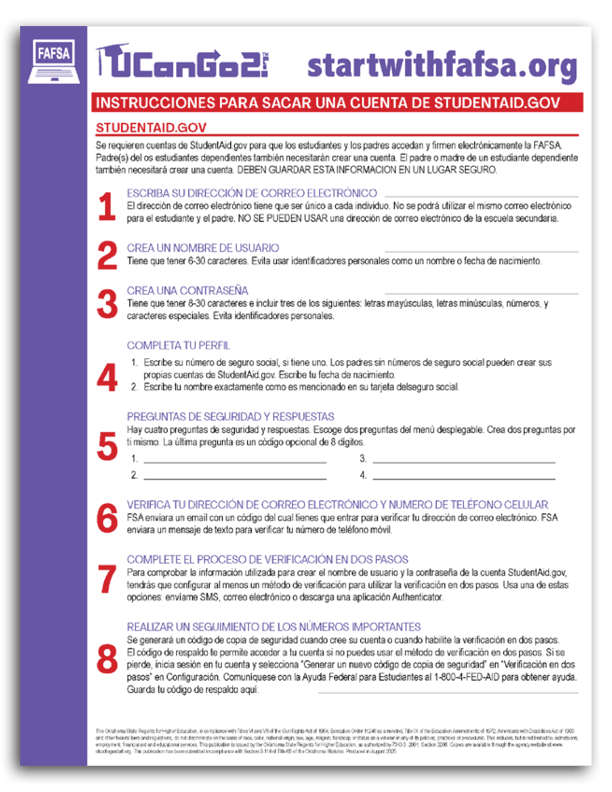

Spanish

|

Use the StudentAid.gov Account Worksheet to keep track of your

username and password.

Visit OKcollegestart's Scholarship Search

to find additional opportunities and check out other resources to

make

college more affordable.

The FAFSA may not be the only form required to receive a

financial aid offer from a school. You must also complete the

college admission process. Check with each of the colleges and

universities you listed on your FAFSA to determine their admission

requirements.

For more information on FAFSA completion, visit StartWithFAFSA.org to find helpful

resources and videos.

|

English

|

Spanish

|